With the end of the 2023-24 financial year in sight, the time has come again to assess your business affairs and plan for tax season. Optima Partners has broken down the essentials of what you need to know before July 1.

Business reporting obligations

Below are a few business reporting obligations to be mindful of when finalising your end-of-year accounts and tax returns.

- Wages reconciliation and STP finalisation

- Superannuation obligation reconciliation – this is not deducible if paid late, and employers must note the change in the SGC rate

- Payroll tax obligations – check you haven’t exceeded thresholds if not registered

- Taxable payment annual reporting (TPAR)

- Building and construction

- Cleaning services

- Road freight and courier services

- IT services

- Security, investigation or surveillance services

- Review accounting data files for potential conversion or rate changes

Superannuation guarantee

Compulsory employer superannuation contributions are rising to 11.5% in the next financial year.

- 2023 10.5%

- 2024 11%

- 2025 11.5%

- 2026 12%

Keep in mind that The Australian Tax Office (ATO) and superannuation funds now have greater oversight than ever of a business’ superannuation obligations. The ATO has also indicated that future obligations will need to be paid in real time (i.e. PAYGW and Super) upon payment of wages.

Tax and compliance updates

There are a few important tax and compliance changes to consider, including:

- ATO is extending compliance programs/digital ID systems

- Temporary Full Expensing has ended on June 30, 2023 but instant asset write-off still applies to assets under $20,000 for FY24 and FY25

- 20% Technology Investment Boost for the 2023 financial year

- 20% Skills and Training Boost for the 2023 financial year

- 20% Proposed Efficient Energy Use Boost for the 2024 financial year

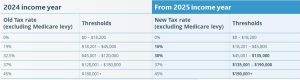

Stage three personal tax cuts

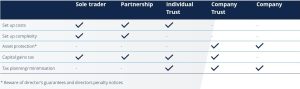

Business structures & tax outcomes

- Section 100a and trust distributions – keep records of payments to beneficiaries

- Potential to distribution to investment companies to retain corporate tax rate

- Division 7a – check owners drawings from companies and ensure repayments are made

- Consider personal tax positions – rental properties, personal deductions, impact of changes in tax rates, personal super contributions

EOFY checklist

- Review year to date figures to determine likely tax liability

- Consider strategies for management of the likely tax position

- Determine dividends to be declared for companies

- Prepare distribution minutes for trusts

- Consider owners remuneration and optimise tax outcome

- Small Business Entities – cash vs. accruals/prepayments/depreciation

- Make superannuation payments as they are only deductible when paid

- Debtor analysis – consider bad debts/timing of invoicing

- Creditor analysis – bring forward expenses to get a tax deduction

- Stock take – undertake a stock take and consider obsolete stock

- Plant and equipment – consider any new equipment needed and ensure its available and ready for use prior to June 30

- Fringe Benefits Tax – if FBT return not lodged consider private portion of expenses and GST adjustments

- Capital Gains Tax – consider the sale of any investments and prepare likely tax calculations

Other Considerations

- ESG reporting begins in January 2025

- Be sure to plan for one off transactions – e.g. Business sales or purchases

- Consider the relevance of your existing accounting systems and evaluate new technology

- Do you have a Self-managed Super Fund? Consider the impact on your business

- Have you purchased any property or business premises? Do you intend to?

Optima Partners offers support to all businesses, whatever your requirements.

If you require more insight or you’d like to discuss your unique circumstances, please email info@optimapartners.com.au for a free one-hour consultation.